2025 Standard Deduction Amount

2025 Standard Deduction Amount. Single or married filing separately—$14,600. The additional standard deduction amount for 2025 (returns usually filed in early 2025) is $1,550 ($1,950 if unmarried and not a surviving spouse).

Most taxpayers now qualify for the standard deduction, but there are some important details involving itemized deductions that people should keep in mind. The standard deduction is a specific dollar amount that reduces the amount of income on which you’re taxed.

Standard Deduction 2025 Chart Ann Amelina, The additional standard deduction amount for 2025 (returns usually filed in early 2025) is $1,550 ($1,950 if unmarried and not a surviving spouse).

Irs 2025 Standard Deductions And Tax Brackets Loni Marcela, About 90% of all taxpayers take the standard deduction.

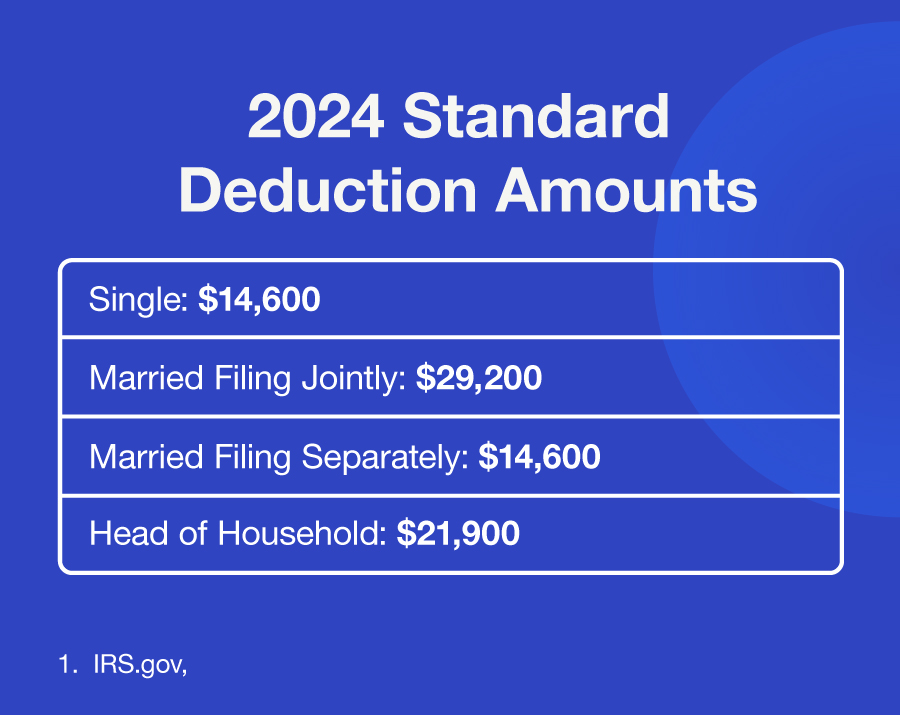

How Much Is The Standard Deduction For 2025 Nicol Anabelle, — the 2025 standard deduction for tax returns filed in 2025 is $14,600 for single filers, $29,200 for joint filers or $21,900 for heads of household.

2025 Tax Brackets And Deductions kenna almeria, — for the 2025 tax year, the standard deduction will increase by $750 for single filers and those married filing separately, $1,500 for married filing jointly, and $1,100 for heads of household.

Tax Brackets And Standard Deductions For 2025 Patty Bernelle, The standard deduction for 2025 varies depending on filing status.

2025 Irs Standard Deduction Amount Kaia Stacia, About 90% of all taxpayers take the standard deduction.

What’s My 2025 Tax Bracket? Brian Freeman, — for the 2025 tax year (for forms you file in 2025), the standard deduction is $13,850 for single filers and married couples filing separately, $27,700 for married couples filing jointly and.

List Of Standard Deductions 2025 Single Vevay Jennifer, — what is the standard deduction for 2025?

2025 Standard Deduction Over 65 Tax Brackets Asia Sybila, The additional standard deduction amount for 2025 (returns usually filed in early 2025) is $1,550 ($1,950 if unmarried and not a surviving spouse).